Online Forex Trading A Comprehensive Guide for Beginners and Experts

Online Forex Trading: A Comprehensive Guide for Beginners and Experts

Online forex trading has become increasingly popular in recent years, drawing millions of traders from around the globe. With a daily turnover exceeding $6 trillion, the forex market is the largest financial market in the world. The allure of making quick profits, the ability to trade 24/5, and the availability of leverage attract both novice and experienced traders alike. If you’re looking to dive into this lucrative market, it’s essential to understand the fundamentals, strategies, and platforms available, as well as the importance of selecting the right broker. For instance, online forex trading South Africa Brokers offer a range of services that cater specifically to local traders.

Understanding Forex Trading

The foreign exchange (forex) market is a decentralized global market for trading national currencies against one another. Unlike stock markets, forex trading does not take place on a centralized exchange but rather in an over-the-counter (OTC) space where all trades are conducted electronically. This means that forex trading can be done from virtually anywhere in the world, as long as you have an internet connection.

How Forex Trading Works

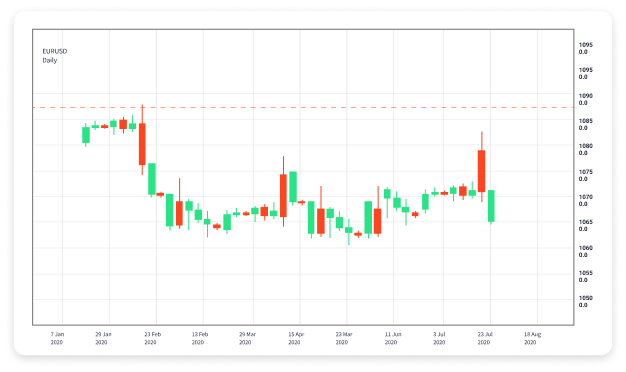

Forex trading involves the buying and selling of currency pairs, which are currencies paired together for trading purposes. For example, the EUR/USD currency pair indicates how many US dollars (the quote currency) it takes to buy one euro (the base currency). Traders speculate on whether the base currency will strengthen or weaken against the quote currency. If they believe the euro will rise against the dollar, they will buy the pair; if they anticipate a decline, they will sell it.

Key Concepts in Forex Trading

1. Currency Pairs

There are three main types of currency pairs: major pairs, minor pairs, and exotic pairs. Major pairs consist of the most traded currencies globally, such as EUR/USD, USD/JPY, and GBP/USD. Minor pairs do not include the US dollar but involve other major currencies, while exotic pairs combine a major currency with a currency from a developing or emerging economy.

2. Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. For instance, with 100:1 leverage, a trader can control a $10,000 position with only $100 of their own money. While leverage can magnify profits, it can also increase losses, making risk management crucial in forex trading.

3. Spreads and Pips

The spread is the difference between the bid price (what you can sell a currency for) and the ask price (what you can buy a currency for). This is how brokers make their money. A pip is the smallest price movement in a currency pair, typically represented by the fourth decimal place (0.0001). Understanding spreads and pips is vital for effective trading.

Choosing a Forex Broker

Choosing the right forex broker is critical for successful trading. Brokers offer various services, including access to trading platforms, research, educational resources, and customer support. Here are a few factors to consider when selecting a forex broker:

- Regulation: Ensure that the broker is regulated by a reputable financial authority. Regulatory bodies help protect traders from fraud.

- Trading Platform: The trading platform should be user-friendly and provide necessary features such as charting tools, news feeds, and automated trading options.

- Fees and Spreads: Compare the trading costs, including spreads, commissions, and overnight fees, to find a broker that fits your budget.

- Customer Support: Look for brokers offering responsive customer service through multiple channels (chat, email, phone).

Trading Strategies in Forex

Effective trading strategies can help you achieve consistent profits. Here are some popular strategies used by traders:

1. Day Trading

Day trading involves opening and closing positions within the same trading day. Day traders take advantage of small price movements using technical analysis and may execute multiple trades in a day.

2. Swing Trading

Swing trading aims to capture shorter-term market moves, holding positions for several days to weeks. Swing traders typically use a combination of technical and fundamental analysis to determine their entry and exit points.

3. Scalping

Scalping is a high-frequency trading strategy where traders make numerous small profits over short time frames. Scalpers rely on quick decision-making and efficient execution to take advantage of small price fluctuations.

Risk Management in Forex Trading

Proper risk management is essential in forex trading to minimize losses and protect your capital. Here are some strategies to incorporate into your trading plan:

- Position Sizing: Determine the size of your trades based on your trading account balance and risk tolerance.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses on trades. A stop-loss order automatically closes a trade when the price reaches a predetermined level.

- Diversification: Avoid concentrating your trading capital in one currency pair. Diversifying across multiple pairs can reduce risk.

The Importance of Continuous Learning

Forex trading is a dynamic field that requires ongoing education to keep up with market trends and developments. Many traders utilize educational resources, webinars, trading courses, and online forums to improve their knowledge and skill set. Staying informed about economic indicators, geopolitical events, and market sentiment can give you a trading edge.

Conclusion

Online forex trading offers lucrative opportunities for individuals seeking financial independence. By understanding the fundamentals, choosing the right broker, developing effective trading strategies, and implementing sound risk management practices, traders can navigate the complexities of the forex market. With continuous learning and practice, anyone can become a successful forex trader. Remember to start with a demo account to test your strategies before committing real capital to the market.