Mastering Forex Exchange Trading Strategies for Success

Forex exchange trading offers a unique opportunity for individuals to engage in one of the largest financial markets in the world, generating billions of dollars in daily transactions. This dynamic market operates 24 hours a day, five days a week, providing ample opportunity for traders to profit from currency fluctuations. If you’re looking to dive into forex trading, forex exchange trading trading-terminal.com can be an essential resource for market analysis and trading tools.

Understanding Forex Exchange Trading

The forex market, or foreign exchange market, is where currencies are traded. It is the largest financial market globally, with an average daily trading volume exceeding $6 trillion. Unlike stock markets, forex operates over-the-counter (OTC), meaning that transactions occur electronically via a network of banks, brokers, and traders. This decentralized structure allows for continuous trading, making forex a fluid and accessible market.

Currency Pairs: The Basics

In forex trading, currencies are traded in pairs, such as EUR/USD or USD/JPY. The first currency in the pair is known as the base currency, while the second one is the quote currency. The price of a currency pair indicates how much of the quote currency is required to purchase one unit of the base currency. Understanding these currency pairs is crucial for analyzing market movements and executing trades effectively.

Types of Forex Analysis

Successful forex trading hinges on effective analysis. Three primary types of analysis can help traders make informed decisions:

1. Fundamental Analysis

This approach involves examining economic indicators, news events, and geopolitical developments that influence currency values. Key economic indicators include gross domestic product (GDP), employment figures, interest rates, and inflation rates. Traders who employ fundamental analysis focus on how these factors may impact currency strength and market trends.

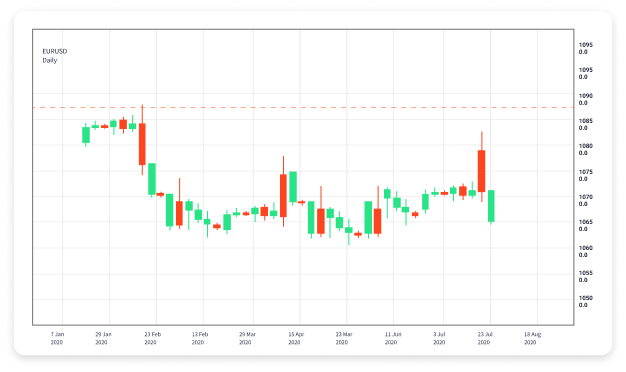

2. Technical Analysis

Technical analysis relies on historical price data and chart patterns. Traders use various tools and indicators, such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels, to identify potential entry and exit points in the market. Understanding chart patterns, such as head and shoulders or double tops, can also provide valuable insights into market behavior.

3. Sentiment Analysis

Sentiment analysis evaluates the overall mood of the market and the trading community. Tools such as the Commitment of Traders (COT) report and market sentiment indicators help traders gauge whether participants are predominantly bullish or bearish. By understanding market sentiment, traders can make more informed decisions, especially in volatile situations.

Risk Management in Forex Trading

Risk management is a vital component of successful forex trading. It involves strategies and techniques to minimize losses while maximizing potential profits. Here are several effective risk management practices:

1. Set a Risk-Reward Ratio

This ratio helps traders determine the potential profit compared to the potential loss of a trade. A common risk-reward ratio is 1:3, meaning that for every $1 risked, the potential reward should be $3. Adhering to a risk-reward ratio can help manage overall trading risks and enhance profitability.

2. Use Stop-Loss Orders

Stop-loss orders are predetermined price levels at which a trader will exit a losing trade to limit their losses. By setting stop-loss orders, traders can protect their capital and prevent emotional decision-making, which can lead to further losses.

3. Diversify Your Portfolio

Diversifying your trading portfolio by investing in multiple currency pairs can help spread risk. It reduces exposure to a single currency and offers potential opportunities in different market conditions. Traders should consider diversifying their trades based on correlations among currency pairs.

The Psychology of Trading

Trading psychology plays a significant role in a trader’s success and failure. Successful traders develop the mental discipline needed to adhere to their trading plans and strategies without being swayed by emotions. Here are essential psychological aspects to consider:

1. Control Emotions

Fear and greed can cloud judgment and lead to impulsive trading decisions. Successful traders learn to manage their emotions and stick to their trading strategies, regardless of market conditions.

2. Develop Patience

Patience is crucial in forex trading. Traders should avoid the temptation to chase losses or enter trades based on impulsive feelings. Instead, successful traders wait for the right opportunities that align with their strategies.

3. Maintain a Trading Journal

A trading journal helps traders document their trades, strategies, and emotional states. Analyzing past trades allows traders to identify patterns, strengths, and weaknesses, leading to continuous improvement in their trading performance.

Choosing the Right Forex Broker

Selecting a reputable forex broker is essential for ensuring a smooth trading experience. Traders should consider several factors when choosing a broker:

1. Regulation and Reputation

It is crucial to choose a broker regulated by a recognized authority. Regulatory agencies help ensure that brokers adhere to strict financial standards, providing a level of security to traders.

2. Trading Platforms and Tools

The trading platform used by a broker significantly impacts the trading experience. Traders should look for user-friendly platforms with advanced charting tools, technical analysis features, and access to economic news and data.

3. Account Types and Spreads

Different brokers offer various account types, which may cater to different trading styles. Additionally, comparing spreads (the difference between the bid and ask price) is vital for cost-effective trading. Lower spreads generally lead to more profitable trades.

Final Thoughts

Forex exchange trading can be a rewarding venture, offering ample opportunities for profit. However, it requires a solid understanding of market dynamics, effective trading strategies, risk management, and psychological resilience. By educating yourself, utilizing the right tools, and continually refining your trading skills, you can increase your chances of success in the forex market. Remember to start small, keep learning, and adapt to the ever-changing market conditions.