Forex Trading for Beginners A Comprehensive Guide 1862076954

Forex Trading for Beginners: A Comprehensive Guide

Forex trading, or foreign exchange trading, involves buying and selling currencies with the goal of making a profit. It is one of the largest financial markets in the world, with a daily trading volume exceeding $6 trillion. For beginners, entering the Forex market can seem daunting, but it can also be an exciting opportunity to grow wealth. In this guide, we will cover the fundamentals of Forex trading, including essential concepts, strategies, and risks associated with trading, as well as resources like forex trading for beginners Best Indonesian Brokers to help you get started.

Understanding Forex Trading

At its core, Forex trading entails exchanging one currency for another in the hope that the price of one currency will rise or fall relative to another. For instance, if you believe that the Euro (EUR) will strengthen against the US Dollar (USD), you would buy the EUR/USD currency pair. Conversely, if you think the Euro will weaken against the Dollar, you would sell the pair.

The Forex Market Structure

The Forex market is unique in that it operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time. The market is decentralized, meaning there is no central exchange. Instead, trading occurs through a network of banks, brokers, and financial institutions around the world.

Major trading centers include London, New York, Tokyo, and Sydney. The different time zones contribute to the market’s continuous operation, with peak trading times during the overlap of major financial hubs.

Major Currency Pairs

Forex trading primarily involves five major currencies, which are traded in currency pairs. The key currency pairs include:

- EUR/USD – Euro / US Dollar

- USD/JPY – US Dollar / Japanese Yen

- GBP/USD – British Pound / US Dollar

- USD/CHF – US Dollar / Swiss Franc

- AUD/USD – Australian Dollar / US Dollar

These pairs are known for their liquidity and volatility, making them popular choices for traders. Understanding the factors that influence these currencies will help beginners make informed trading decisions.

Getting Started with Forex Trading

Before diving into Forex trading, it’s crucial to develop a solid understanding of the market and create a trading plan. Here are the steps to get started:

1. Educate Yourself

Take the time to learn about the Forex market. There are numerous online resources, courses, and books dedicated to Forex trading for beginners. Look for reputable sources that explain the basics, trading strategies, and market analysis.

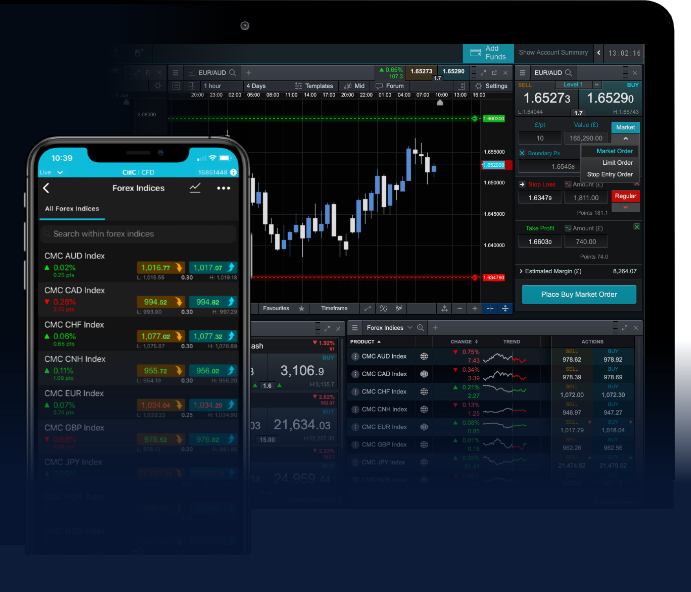

2. Choose a Reliable Forex Broker

Selecting the right broker is vital to your trading success. Look for a broker that is regulated, offers a user-friendly trading platform, and provides access to educational resources. Consider using comparators to find the Best Indonesian Brokers based on your trading needs.

3. Open a Demo Account

Most brokers offer demo accounts that allow you to practice trading with virtual money. This is a great way for beginners to become familiar with the trading platform, test strategies, and develop confidence before risking real capital.

4. Develop a Trading Strategy

A successful trading strategy is essential for navigating the Forex market. It should include entry and exit points, risk management strategies, and rules for handling losing trades. Beginners often use technical analysis, fundamental analysis, or a combination of both to make informed trading decisions.

5. Manage Risk

Risk management is critical in Forex trading. Determine how much capital you are willing to risk on each trade and use stop-loss orders to minimize potential losses. Never risk more than you can afford to lose.

Understanding Forex Analysis

Forex analysis is divided into two primary categories: technical analysis and fundamental analysis.

Technical Analysis

This involves analyzing price charts and using various indicators to predict future price movements. Traders often rely on historical price patterns, trends, and support and resistance levels to make trading decisions.

Fundamental Analysis

This approach focuses on economic indicators, such as interest rates, inflation, and employment data. Traders who use fundamental analysis often pay attention to news events and economic releases that can affect currency prices.

Common Mistakes to Avoid

As a beginner, it’s crucial to learn from the experiences of others. Here are some common mistakes that new Forex traders tend to make:

- Overleveraging: Using too much leverage can lead to significant losses.

- Neglecting Risk Management: Failing to implement risk management strategies can result in losing more than anticipated.

- Chasing Losses: Trying to recover losses can lead to impulsive decisions and increased risk.

- Not Staying Informed: The Forex market is influenced by numerous factors; staying informed is essential for successful trading.

- Trading Emotionally: Letting emotions drive trading decisions can lead to poor outcomes. Stick to your trading plan.

Conclusion

Forex trading offers a wealth of opportunities for those willing to learn and practice. For beginners, understanding the market dynamics, implementing effective trading strategies, and practicing risk management are key components of a successful trading journey. As you embark on this exciting venture, continue to educate yourself, stay informed about market trends, and seek reliable resources and brokers to guide your trading experiences. Happy trading!