Mastering PrimeXBT Spot Trading Your Guide to Success

In the rapidly evolving world of cryptocurrencies, trading platforms like PrimeXBT Spot Trading PrimeXBT’de spot işlem are reshaping how investors approach the market. Spot trading, in particular, has become a popular choice for traders looking for quick and efficient transactions. This article will delve into the fundamentals of PrimeXBT spot trading, exploring what it is, how it works, and the strategies you can implement to enhance your trading experience.

What is Spot Trading?

Spot trading refers to the purchase or sale of a financial instrument, such as cryptocurrencies, for immediate delivery and settlement. This differs from futures or options trading, where contracts are executed at a future date. In spot trading, transactions are settled “on the spot,” meaning that the buyer receives the asset immediately, and the seller gets paid right away. The price at which the transaction occurs is known as the spot price, which reflects the current market value of the asset.

Understanding the PrimeXBT Platform

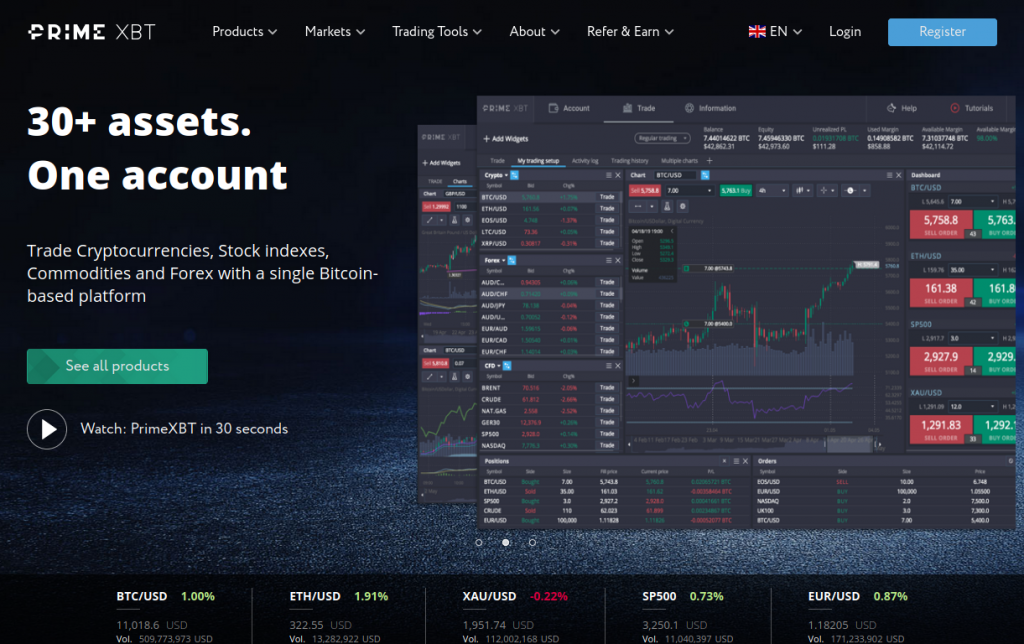

PrimeXBT is a leading cryptocurrency exchange offering a wide range of trading options, including spot trading. The platform is well-known for its user-friendly interface, robust trading tools, and a vast selection of cryptocurrencies available for trading. With PrimeXBT, users can trade major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many altcoins in a spot trading environment, which is particularly appealing to both new and experienced traders.

Features of PrimeXBT Spot Trading

When you choose to engage in spot trading on PrimeXBT, you gain access to a variety of features that can enhance your trading experience:

- User-Friendly Interface: The PrimeXBT platform is designed to be intuitive, making it accessible for traders of all levels. Whether you’re a newcomer or a seasoned veteran, navigating the interface is simple.

- Diverse Asset Selection: PrimeXBT provides access to a wide range of cryptocurrencies, allowing traders to diversify their portfolios easily. Investors can take positions in both major and lesser-known coins.

- High Liquidity: Spot trading on PrimeXBT benefits from high liquidity, enabling users to execute trades quickly and efficiently without large price slippage.

- Real-Time Market Data: Access to real-time market data, charts, and analytics helps traders make informed decisions when executing spot trades.

- Low Trading Fees: PrimeXBT offers competitive trading fees, which can significantly impact profitability for active traders dealing in high volumes.

Benefits of Spot Trading on PrimeXBT

Spot trading on PrimeXBT carries several advantages that can enhance the trading experience:

- Immediate Ownership: When you engage in spot trading, you instantly own the cryptocurrency bought, which allows you to store, hold, or sell it whenever you wish.

- Simplicity: Spot trading is straightforward and easy to understand, making it an excellent choice for traders who prefer a more direct approach to investing in cryptocurrencies.

- No Leverage Risks: Unlike margin trading, spot trading does not involve borrowing funds to trade, eliminating the risks associated with leverage, such as potential liquidation of assets.

- Price Transparency: Spot trading prices are determined by supply and demand dynamics in real-time, providing clear price signals to traders.

Strategies for Successful Spot Trading

To utilize spot trading effectively, traders should adopt strategies that align with their goals and risk tolerance:

1. Fundamental Analysis

Understanding the driving factors behind a cryptocurrency’s price can provide valuable insights. Traders should pay attention to news events, technological developments, market trends, and regulatory changes that may impact price movements.

2. Technical Analysis

Use technical analysis tools, such as moving averages, support and resistance levels, and volume indicators to identify trading opportunities. Analyzing charts can reveal patterns that forecast future price movements.

3. Diversification

Diversifying a portfolio by trading different cryptocurrencies can minimize risk. Investors should avoid concentrating their funds in a single asset and instead explore a balanced approach across multiple cryptocurrencies.

4. Setting Stop-Loss and Take-Profit Orders

Implementing stop-loss and take-profit orders can help manage risk and lock in profits. A stop-loss order automatically sells an asset when it reaches a specified price, while a take-profit order secures profits when the asset hits a certain target price.

Common Mistakes to Avoid

Even experienced traders can fall victim to common mistakes in spot trading. Here are some pitfalls to avoid:

- Panic Selling: Emotional responses to market fluctuations can lead to irrational decisions. Traders should stick to their strategies and not let fear dictate actions.

- Chasing Losses: Attempting to recover lost investments can lead to further losses. It’s essential to remain disciplined and not overtrade out of desperation.

- Neglecting Research: Failing to conduct proper research can result in poor trading choices. Staying informed about market trends and news events is crucial.

- Lack of a Trading Plan: Entering the market without a clear trading plan can result in confusion and inconsistency. Having a well-defined plan guides trading decisions and fosters discipline.

Conclusion

PrimeXBT spot trading offers a compelling opportunity for traders looking to capitalize on the volatility of cryptocurrencies. By understanding the platform’s features, benefits, and effective trading strategies, you can navigate the market with confidence. Whether you are a novice or an experienced trader, adopting sound trading principles while utilizing PrimeXBT’s user-friendly platform can significantly enhance your trading potential. As always, it’s essential to approach cryptocurrency trading with caution and thorough research to maximize your chances of success.