Chainlink Price Prediction on PrimeXBT What You Need to Know

Chainlink Price Prediction on PrimeXBT: What You Need to Know

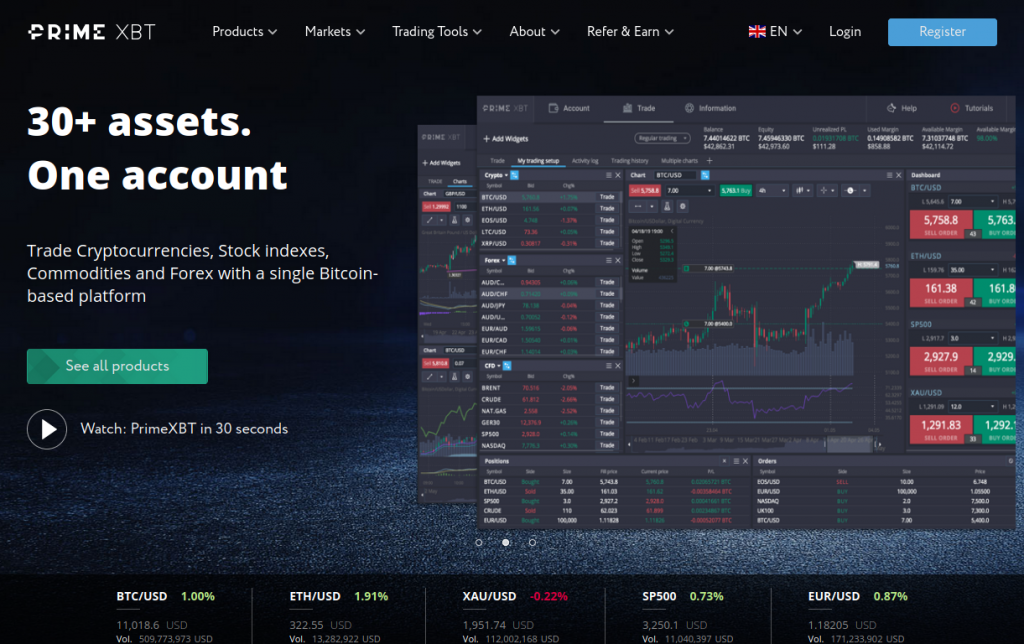

As the cryptocurrency market evolves, investors and traders continuously seek to forecast price movements of prominent assets. One such asset is Chainlink (LINK), a decentralized oracle network that has gained significant traction in the blockchain ecosystem. With its ability to connect smart contracts with real-world data, LINK is becoming a favorite among traders on various exchanges, including PrimeXBT. In this analysis, we will delve into the factors influencing Chainlink’s price, explore expert predictions, and examine strategies that can be employed on chainlink price prediction primexbt https://review-primexbt.com/limit-vs-market-order/ for maximizing trading potential.

Understanding Chainlink and Its Market Position

Chainlink was launched in 2017 and quickly established itself as a leader in the decentralized oracle space. This technology allows blockchains to interact with external data sources, making it invaluable for decentralized finance (DeFi) applications and other blockchain-based solutions. As the demand for smart contracts and decentralized applications continues to rise, so does the relevance of Chainlink. With partnerships with major firms and integration into various DeFi projects, LINK has positioned itself as a crucial player in the cryptocurrency market.

Factors Influencing Chainlink’s Price

A number of factors can influence the price of Chainlink and how it is perceived in the market. Understanding these factors can provide insights into price predictions:

- Market Sentiment: General market trends and investor sentiment play a crucial role in price movements. Positive news regarding blockchain technology or major partnerships can lead to bullish behavior in LINK’s price.

- Adoption and Usage: The more Chainlink is used within smart contracts and dApps, the stronger the demand for LINK will be. Adoption metrics can be a reliable indicator of potential future price increases.

- Technological Developments: Upgrades to Chainlink’s protocol or integrations with more blockchains can strengthen its position in the marketplace, impacting price positively.

- Market Competition: With several other oracle solutions emerging, competition may affect LINK’s market share and, consequently, its price. Keeping an eye on competitors can provide context for price movements.

- Overall Crypto Market Trends: The broader cryptocurrency market trends also significantly impact Chainlink’s price. Correlation with major cryptocurrencies like Bitcoin and Ethereum is often observed.

Price Predictions for Chainlink

Experts and analysts have varying opinions on the future price of Chainlink. Some forecast considerable growth, while others advise caution due to market volatility. Here are some price predictions based on different analytical approaches:

1. Technical Analysis

Technical analysis employs historical price data and trading volumes to predict future price movements. For Chainlink, several indicators suggest a potential upward trajectory. Key support and resistance levels can offer insights into where the price may stabilize or reverse. Analysts often look for breakout patterns or changes in trading volume that could indicate a future price rise.

2. Fundamental Analysis

Fundamental analysis focuses on the underlying value and potential of the asset. For Chainlink, this would involve examining its partnerships, use cases, and technological advancements. Given its substantial role in the DeFi space, many experts believe there is significant room for growth, provided the adoption rate continues to rise.

3. Market Sentiment Analysis

Sentiment analysis involves gauging the mood of the market, often through social media and news outlets. Currently, sentiment around Chainlink tends to be bullish, especially with increasing attention towards DeFi. Positive sentiment often correlates with rising prices, creating a feedback loop where enthusiasm drives buying behavior.

Trading Strategies on PrimeXBT

When trading Chainlink on PrimeXBT, traders can employ various strategies to optimize their investments. Here are some key strategies to consider:

- Leverage Trading: PrimeXBT offers leverage, allowing traders to amplify their exposure to price movements. However, this can increase risk, so it’s crucial to have a solid risk management strategy in place.

- Stop-Loss Orders: Implementing stop-loss orders can help mitigate potential losses. These orders automatically sell assets at a predetermined price, allowing traders to protect their investments even in a volatile market.

- Technical Indicators: Utilizing tools like Moving Averages, RSI, or MACD can provide deeper insights into price trends and potential entry and exit points.

- Diversification: While Chainlink may be a strong asset, diversifying across different cryptocurrencies can reduce risk and increase the potential for profit during various market conditions.

Conclusion

Chainlink remains a prominent and influential player in the cryptocurrency market. As its adoption continues to rise and the demand for decentralized oracles grows, LINK’s price potential seems promising. However, traders should remain mindful of the various factors influencing price fluctuations and employ effective trading strategies while using platforms like PrimeXBT. By staying informed and prepared, investors can navigate the complexities of the market and potentially capitalize on the opportunities presented by Chainlink.