Essential Forex Trading Strategies for Beginners A Comprehensive Guide

Essential Forex Trading Strategies for Beginners

If you’re new to the world of trading, understanding forex trading can initially seem like a daunting task. However, with the right strategies, tools, and mindset, it can be a rewarding venture. Here, we unveil essential forex trading strategies for beginners that will help you establish a strong foundation in trading. Don’t forget to explore forex trading strategies for beginners Forex Trading Platforms to find the right tools for your trading journey.

Understanding Forex Trading

The forex market, or foreign exchange market, is the largest and most liquid market in the world. It operates 24 hours a day, five days a week, and allows traders to buy, sell, and exchange currencies. The value of different currencies fluctuates based on economic factors, geopolitical events, and market sentiment, providing opportunities for traders to profit from price movements.

Importance of a Trading Plan

One of the first steps for any beginner is to develop a trading plan. This plan should outline your trading goals, risk tolerance, and strategies. Having a clear plan will keep your emotions in check and guide your decisions under different market conditions.

Popular Forex Trading Strategies

1. Scalping

Scalping is a short-term trading strategy that involves making numerous trades throughout the day to capture small price movements. Scalpers usually hold their positions for just a few seconds or minutes. This strategy requires a solid grasp of technical analysis and can be stressful due to the constant need for decision-making.

2. Day Trading

Day trading involves buying and selling currencies within the same day. Day traders close all positions before the market closes to avoid overnight risk. This strategy requires a good understanding of market indicators and the ability to act quickly on news and data releases.

3. Swing Trading

Swing trading is a medium-term strategy that aims to capture price movements over a few days to weeks. Swing traders utilize technical analysis to identify potential market reversals and optimum entry points. This strategy allows for a more relaxed pace compared to scalping and day trading.

4. Trend Following

Trend following is a strategy that involves analyzing the market to identify and follow trends. Traders can take long positions in an uptrend and short positions in a downtrend. This approach works on the assumption that trending markets are more likely to continue in the same direction.

Technical Analysis Tools

Technical analysis plays a crucial role in forex trading. Beginner traders should familiarize themselves with various analysis tools, including:

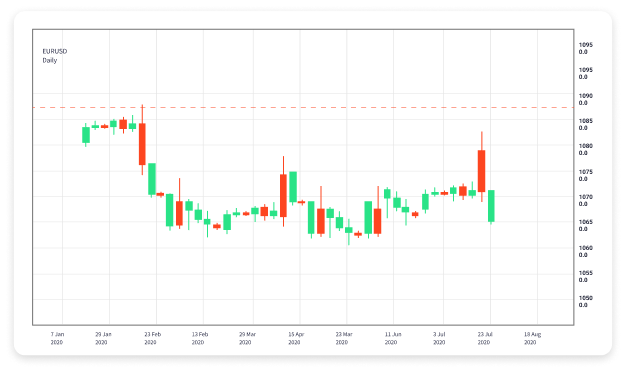

- Charts: Candlestick charts are popular for spotting trends and patterns.

- Indicators: Moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are some commonly used indicators.

- Support and Resistance Levels: Identifying these levels can help you determine entry and exit points.

Risk Management Strategies

Effective risk management is essential for successful trading. Here are key practices to ensure you protect your trading capital:

- Set Stop-Loss Orders: Utilize stop-loss orders to limit potential losses on each trade.

- Position Sizing: Determine the appropriate size of each trade relative to your account balance and risk tolerance.

- Diversification: Avoid putting all your capital into a single trade; consider spreading your investments across various currency pairs.

Psychological Aspects of Trading

Forex trading is as much about psychology as it is about strategy. Understanding and managing your emotions is crucial to making rational decisions. Here are tips for maintaining a healthy trading psychology:

- Avoid Overtrading: Resist the urge to trade frequently; only enter trades that meet your criteria.

- Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Learn from Mistakes: Analyze losing trades to understand what went wrong and how to improve in the future.

Continuous Learning and Adaptation

The forex market is constantly evolving, and as a trader, it’s essential to stay informed about market trends, news, and economic indicators. Continuous learning through books, online courses, webinars, and forums can significantly enhance your trading skills.

Conclusion

Starting your journey in forex trading can be exciting, but it requires dedication, a good understanding of strategies, and discipline. By following the essential forex trading strategies outlined above, you can build a solid foundation for your trading career. Remember that all traders start somewhere, and with time and practice, you can develop into a successful trader. Always stay informed, adapt to changing markets, and never stop learning!